Get assigned a dedicated tax expert today. Fast, affordable and fully HMRC-compliant.

Get assigned a dedicated tax expert today. Fast, affordable

and fully HMRC-compliant.

Self Assessment Tax Returns

Start Your Tax Return With Confidence -

Affordable Tax Solutions

Join over 5,000 happy customers and file your tax return with us

Excellent

Trustpilot

Simple, Straight Forward and Swift

Starts from only £99

Starting from only £99

Start Your Tax Return

No Hidden Fee's & Stress Free

All Completed for you by real accountants, not complicated softwares

Tax Investigation cover

Free HMRC fine appeal

Avoid HMRC fine

Price Match Promise

Minimize your Tax bill

Professional qualified Accountants

Unlimited Tax draft calculation

Return submitted to HMRC online

Excellent

Trustpilot

What is Self Assessment

If an individual working as self employed in UK and already registered for UTR number he/she must have to submit self assessment with HMRC by 31st January succeeding year. It is a system HMRC uses to collect taxes from Individuals who registered self employed.

In simpler words who are other than PAYE earning income in UK are considered as self employed.

What are self assessment tax returns?

Self Assessment Tax Returns allow freelancers, the self-employed, and others to report their earnings and calculate the tax they need to pay. Even if your income is taxed through PAYE, it doesn’t always mean you won’t need to file a return. The Self Assessment system is quite different from Pay As You Earn (PAYE), where tax is deducted automatically from your salary, pension, or savings at source.

You may still need to submit a UK tax return to report any additional income or to claim a tax refund you’re entitled to. If you’re unsure about your situation, our team is here to assist.

While the system is designed to be straightforward, it can sometimes become complicated. Many individuals are unaware of rebates they could claim, or they don’t know the correct steps to recover the full amount they are due. It’s also important to be mindful of submission deadlines, as late filings can result in fines. When completing a Self Assessment tax return, you must declare all taxable income and capital gains, and claim any tax reliefs or allowances you qualify for — so it helps to know exactly what you can claim

How it works?

You just need to follow 3 simple steps

Start your Tax return now

Simply send your income details

Your Tax Return Filed by Your

Accountant

Pay £99 to have your accountant

appointed to you

We will draft your tax return and advise you every step of the way

Done!! Simple, Straight Forward and

Swift – no fine, no stress

Who needs to submit

a Self Assessment Tax Return?

It’s not just the self-employed who need to report their earnings to HMRC and complete a Self Assessment Tax Return. Even if you pay tax through PAYE, this doesn’t automatically mean you won’t need to file. You may still have to submit a UK tax return to report other income or to claim a tax rebate.

If you’re asking yourself, “Do I need to submit a Self Assessment tax return?” — you will likely need to if any of the following apply to you:

You work for yourself or are part of a business partnership

You’re a company director

You have significant savings or investment income

You earn savings or investment income that hasn’t been taxed

You let out land or property

Your household claims Child Benefit and your income is over £50,000

You receive income from abroad

You’ve sold or gifted assets (for example, shares or a holiday home)

You’ve lived or worked outside the UK, or you are not UK-domiciled

What documents do I need to file a

self assessment return?

Completing a Self Assessment tax return means giving HMRC a clear and complete view of your finances —

so having all your paperwork organised is a big help. Below are some key documents you should keep safe:

P45 form — if you left a job during the tax year

P60 form — this shows how much tax you’ve paid

P11D form — if you receive benefits from your employer, like a company car

Records of Taxed Award Schemes or any redundancy payments

It’s also important to keep records of any additional income, such as untaxed tips, bonuses, or benefits like meal vouchers.

And remember — filing a Self Assessment tax return online isn’t just for the self-employed. If you’re claiming back work expenses over £2,514, you’ll also need to use this system.

Why choose us ?

Why choose taxandtraders ?

Self Assessment tax returns are meant to be straightforward — but in reality, they can be anything but simple. At taxandtrader.co.uk, we provide a Self Assessment tax return service that takes care of all the paperwork for you, removing the stress from the process. You won’t need to worry about missing deadlines, making expensive mistakes, or overlooking tax rebates you could claim.

At taxandtrader.co.uk, we know that being self-employed means life can be hectic, and dealing with HMRC is often the last thing you want to think about. The process of figuring out how to file a tax return or the fear of errors that might cost you money shouldn’t take up your time. Our experienced team ensures your Self Assessment tax return is submitted accurately and on time, giving you full peace of mind.

If handling your tax return feels overwhelming, let taxandtrader.co.uk take care of it for you.

We’ll help you save time, reduce stress, and avoid unnecessary costs. We’re here to guide you on how to reduce your tax bill legally and are happy to answer any queries or concerns you may have.

Self Assessment Tax

Return Today

Let us start work on your

Without any hassle...

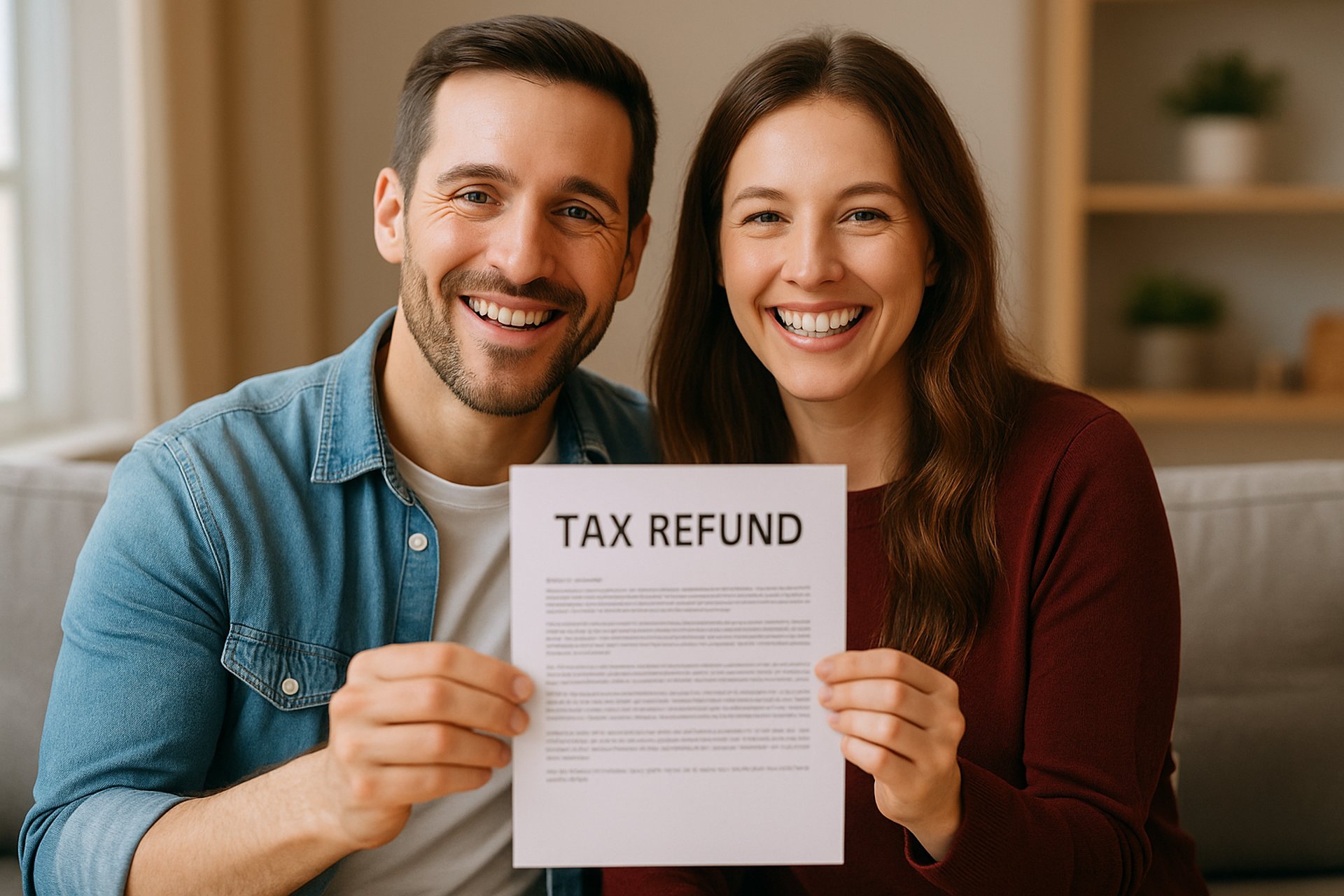

Client Reviews

Hear from our satisfied customers about their experiences.

The service was seamless and made filing my tax return stress-free. Highly recommend!

John Smith

London UK

I was impressed with the professionalism and ease of use. My tax return was completed quickly and accurately. Will definitely use again for future filings.

Emily Jones

Manchester UK