Married? Claim Your Tax Rebate Now!

Did you know that married couples in UK can claim up to £1,005.60 tax back?

In the United Kingdom, married couples or civil partners are eligible to claim a marriage allowance, provided one partner's income is below the basic personal allowance threshold of £12,570. The lower earner can transfer part of this unused tax allowance to the higher earner. If you're married and haven't done this then you can start your tax rebate claim today with our no win, no fee service.

Find out if you're eligible to apply for a marriage in

2 minutes

Are you married or civil Partnership?

What is Marriage Allowance?

Marriage Allowance in the UK is a tax benefit available to married couples and civil partners. It allows the lower-earning partner to transfer part of their unused personal allowance to the higher-earning partner, reducing the overall tax bill for the couple

How does this marriage allowance work?

One partner must have an income below the basic personal allowance (£12,570 for the 2023/2024 tax year).

The other partner must be a basic rate taxpayer (earning between £12,571 and £50,270 for the 2023/2024 tax year).

The lower-earning partner can transfer up to 10% of their personal allowance to the higher-earning partner. For the 2023/2024 tax year, this amount is £1,257.

This transfer can result in a tax saving of up to £251.40 for the year.

Who is Eligible to Apply for Marriage Allowance?

Eligibility for Marriage Allowance in the UK depends on following factors:

Marital Status:

You must be married or in a civil partnership. Unmarried couples, including those living together, are not eligible

Income:

One partner's income must be below the basic personal allowance threshold (£12,570 for the 2023/2024 tax year).

Taxpayer Status:

The other partner must be a basic rate taxpayer, meaning their income is between £12,571 and £50,270 for the 2023/2024 tax year.

Living in the UK:

You must both be living in the UK, or if one of you lives abroad, you may still qualify if you get a personal allowanceIf you meet these criteria, you can apply for Marriage Allowance and potentially save on your overall tax bill.

How to Apply for Marriage Allowance?

Applying for Marriage Allowance in the UK is quite straight forward. Here are the steps:

Gather Necessary Information:

Ensure you have both your and your partner's National Insurance numbers.

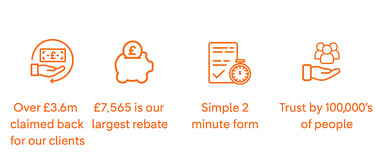

Visit the Taxandtraders Website:

Go to the taxandtraders website, check your eligibility and signup your details.

Complete the Application:

Follow the online prompts to fill out the application.

Upload ID's and Income proof:

You'll need to sign in or create an account if you don't already have one and Once all the above process is completed taxandtraders will review your application and send claim to HMRC.

Client Reviews

Hear from our satisfied customers about their experiences.

The service was seamless and made filing my tax return stress-free. Highly recommend!

John Smith

London UK

I was impressed with the professionalism and ease of use. My tax return was completed quickly and accurately. Will definitely use again for future filings.

Emily Jones

Manchester UK